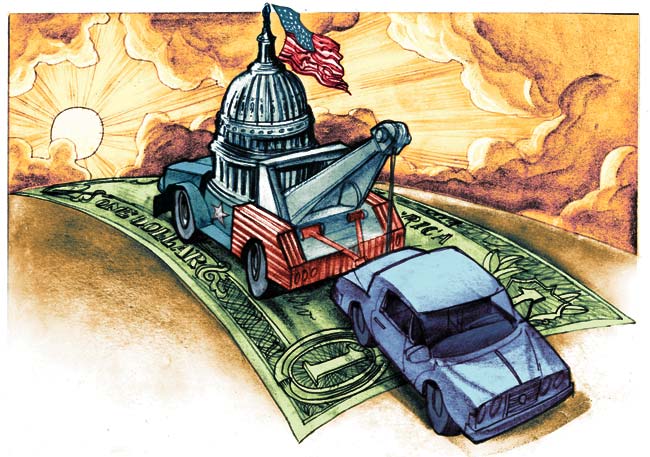

It appears the Obama administration and the Democrat “leadership” in Congress continue to have no shame when it comes to their attempts to buy votes. The latest example – the extension of the “Cash for Clunkers” program that passed in the Senate today.

It appears the Obama administration and the Democrat “leadership” in Congress continue to have no shame when it comes to their attempts to buy votes. The latest example – the extension of the “Cash for Clunkers” program that passed in the Senate today.

In less than a week, the $1 billion allocated for the program was gone so Congress quickly appropriated an additional $2 billion that will supposedly extend the program and see it through until Labor Day.

The program, officially known as the Car Allowance Rebate System, or “CARS” provides $3,500-$4,500 rebates to consumers (depending on model and fuel efficiency). In the early going “CARS” appears to be popular. However, I hasten to remind you that Fannie Mae and Freddy Mac were once popular as well, but fell out of favor after it became obvious that they were an integral part of the housing meltdown that led to the current recession.

CARS is essentially a small scale, vehicular “Fanny Mae” if you will, that serves the same purpose as the 1977 Community Reinvestment Act (CRA) designed to “encourage” commercial banks and savings associations to provide low interest home loans to low- and moderate-income borrowers.

That certainly sounds good, but as they say, the devil is in the details. Ultimately the CRA morphed into a political tool for liberal politicians who used the program to force lenders to provide loans to unqualified borrowers. The political motive for these unscrupulous politicians was pure demagoguery – pandering to a particular socio-economic class that would ultimately translate into more votes.

Barely six months removed from that historic, government-induced economic crash, the Obama administration is driving headlong into another one with this politically motivated scheme that is ostensibly designed to sell cars and stimulate the economy. On its face, there are a number of flaws with the “CARS” program that should have car dealers slamming on the brakes.

First, the dealers who take these clunkers in trade are not allowed to resell them to offset any losses they may incur. Instead they are forced to have the cars crushed, and where they go after that is any body’s guess.

Second, the reality is these rebates amount to little more than a 9-10% discount in real dollars. I don’t see shoppers hurrying to Wal-Mart to save 27 cents on a gallon of milk. However, perception is reality, so the rush to buy a new car is especially urgent when the program may run out of money by Labor Day.

Ultimately, nobody wins here and, as usual the taxpayer picks up the check. The car manufacturers, some of whom have already been bailed out once, are stuck with piles of scrap metal that they can’t do anything with. (I wouldn’t be surprised if the EPA levied fines on them for improper disposal.) Get ready for another car bailout.

Then there’s the new car owners. Many are already experiencing financial strain, and that strain is likely to increase before the new car smell fades. Like many others, I’ve been there, and I can tell you that not having to make a car payment every month – particularly in an economy like this one – is truly a blessing.

Like the recent housing meltdown that led to mass foreclosures across the country, we could be looking at a nationwide wave of car repossessions within six months putting even more pressure on our already vulnerable car industry and further slowing an economy that can’t get out of first gear.

Bottom line – “CARS” is the wrong lubricant for our seizing economic engine.